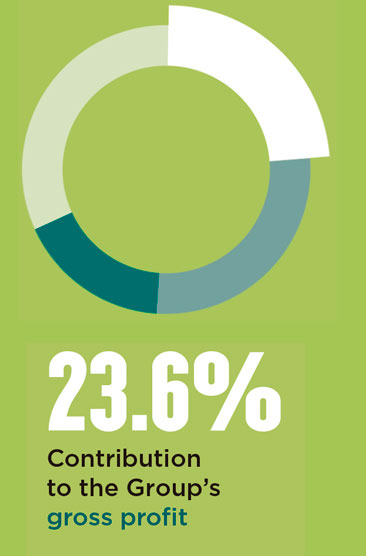

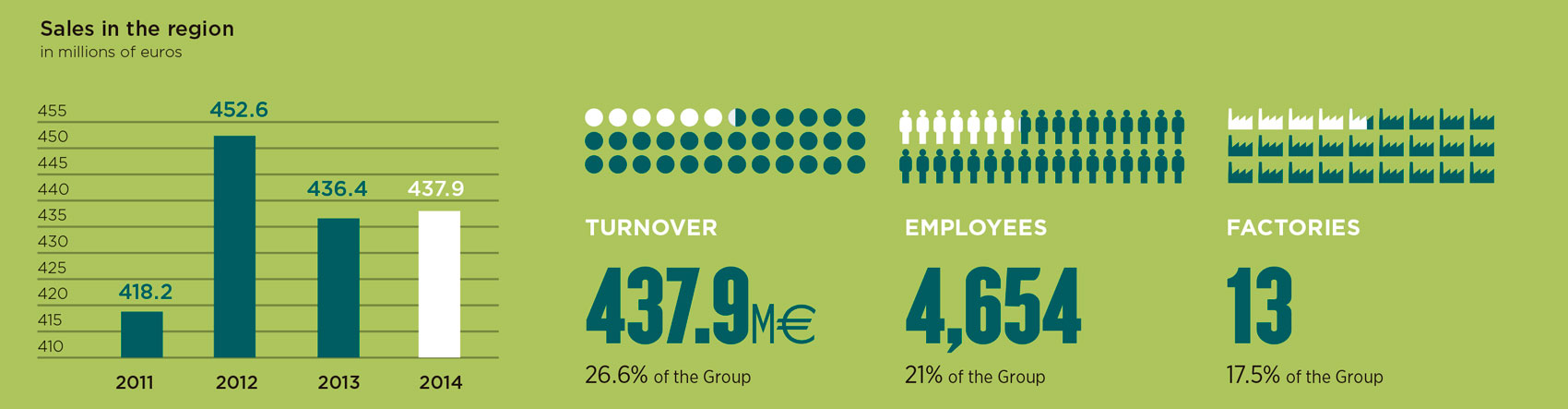

Americas (North, Central and South America)

In 2014 Latin America witnessed a slowdown in activity, affected by unfavorable external conditions and the uncertain outlook of its main economies. Nevertheless, the Group remains committed to he medium and long term growth opportunities offered by the region.

In Brazil, new faucet and furniture assembly plants were commissioned, which reinforce the various brands’ comprehensive offer for the bathroom space and allow us to take part in some of the country’s largest projects.

Argentina witnessed remarkable growth driven by the luxury market, while the tiles business in the US continues to successfully follow the growth strategy through small distributors.

BRAZIL

Interior of the new faucets plant in Recife.

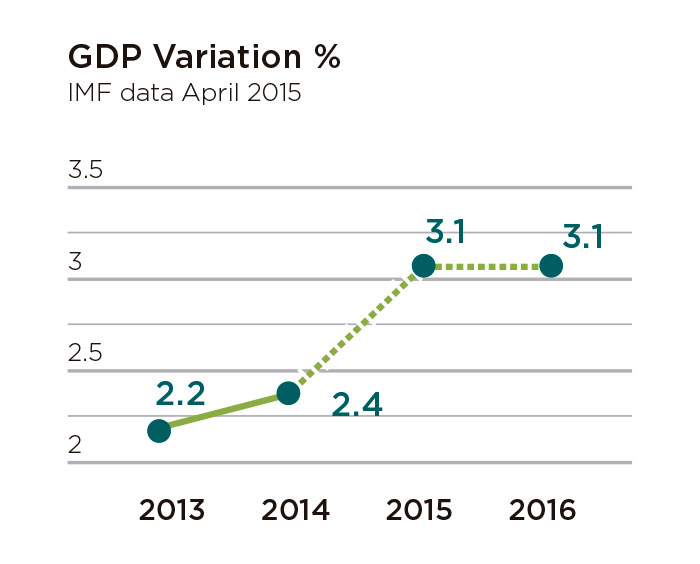

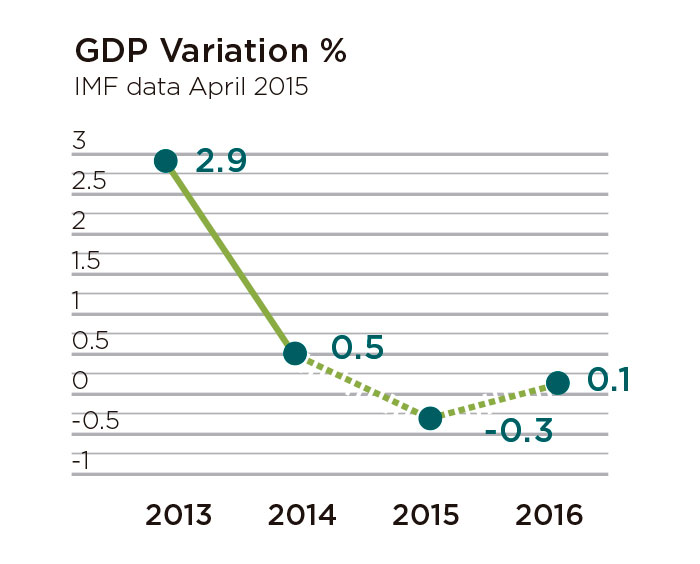

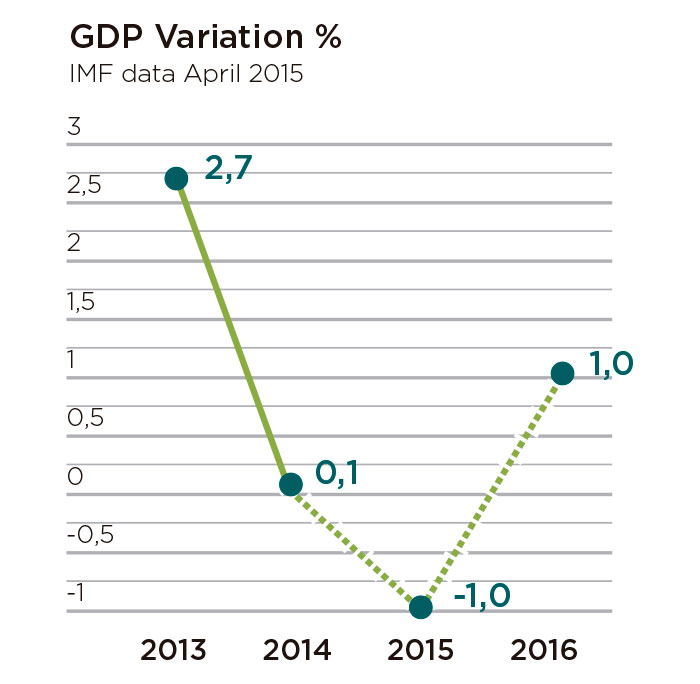

Brazil closed 2014 with stagnating development (0.1%), affected by low business and consumer confidence and the falling price of the main raw materials exported by the country in international markets. Low competitiveness and unfavourable financial conditions constrain investment, while moderation in employment and credit growth inhibit consumption. The reelection of Dilma Rousseff as president in October failed to dispel uncertainty in the short term, in the face of risks such as deteriorating terms of trade, curbing exports, rationing of lectricity and water and the impact of corruption. The government is working to correct distortions by implementing tighter fiscal and monetary policies. In this environment, the building materials sector posted a decline in activity of close to 7%, after four consecutive years of growth.

Interior of the new faucets plant in Recife.

Rio 2016 Olympic Village, equipped with Group porcelain, faucets and tiles.

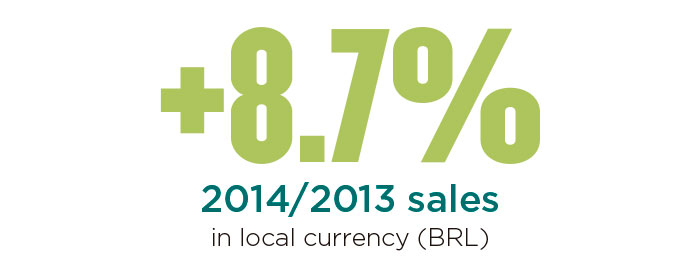

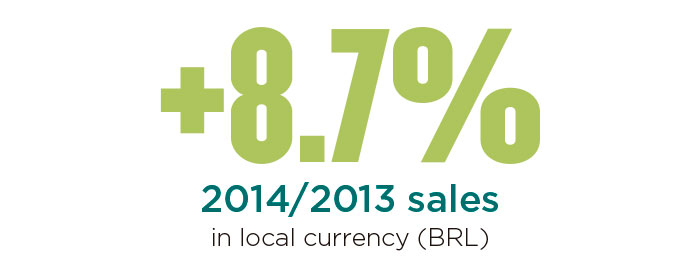

Despite the difficulties, the Group’s bathroom space business saw an increase in turnover of 3% in local currency, driven mainly by growth in the faucet and furniture categories, where the major investments in the country are also allocated (in 2014 the new faucets plant in Recife and furniture assembly plant in Jundiai started operations). In terms of sanitary ware, sales volume remains close to 11 million pieces. The Group ranks as top seller in the country and main benchmark in the sector, as became evident in its presence at Expo Revestir and the Anamaco Award to the best sanitary ware industry company awarded by the association of construction materials.

Commissioning of the new faucets plant in Recife.

In ceramic tile, the strategy to reposition the local brand Incepa in the premium segment fueled a growth of 20%. This strategy is based on developing new formats, applying digital printing for reater product customization and sales efforts aimed at expanding the customer base.

New faucet and furniture plants. Located near Recife (state of Pernambuco), the new complete cycle faucet plant was officially inaugurated in April 2014 with an investment of 14 million euros and a total production capacity of 500,000 pieces per year. It manufactures for Roca, Incepa and Celite brands. The new furniture assembly plant in Jundiai started operations in February with an initial annual capacity of 35,000 pieces for brands like Roca and Celite. With these investments, the Group reinforces the development of new categories in the bathroom space, which in 2014 have already fueled the growth of total sales in the country.

Commissioning of the new faucets plant in Recife.

2016 Rio Olympic Village. Boasting a total of 31 buildings and a capacity for 18,000 athletes, the Rio 2016 Olympic Village is one of the country’s major construction projects. Group brands are present ith more than 28,000 pieces of porcelain and 31,000 faucets and about 400,000 square meters of ceramic tile, as well as accessories and fixtures.

ARGENTINA

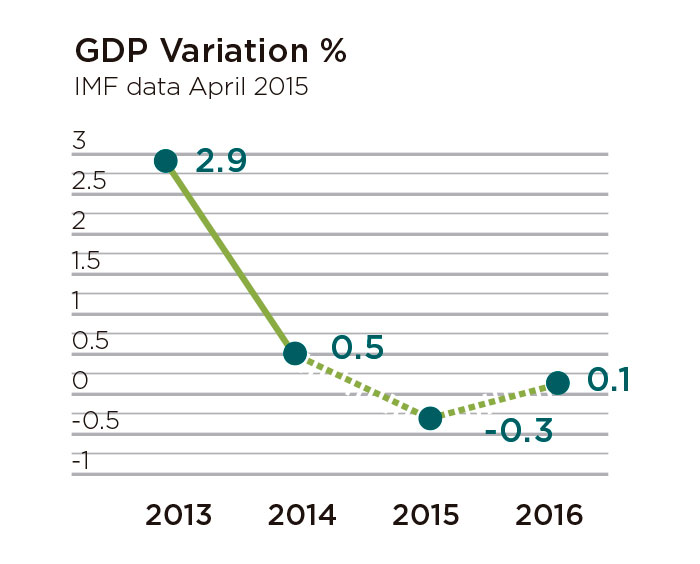

In the wake of growth achieved in 2013, in 2014 Argentina slipped into recession due to the profound macroeconomic imbalances and an economic policy that fails to curb its high inflation and currency depreciation and continues to inflict exchange restrictions.

Despite the recessionary macroeconomic situation and the recessionary construction scenario, the bathroom space sector has retained its dynamism, driven mainly by new construction. The Group celebrated its 20th anniversary in the country with a 36% sales increase in local currency, driven largely by sales growth in the more profitable medium and premium segments (9%) and the success of The Gap series.

20th anniversary in Argentina. The Roca Group’s presence in the country dates back to 1994, when it acquired an industrial plant owned by the Capea brand, which then accounted for 7% of the market share. Today, after a gradual process of technological investment and business development, the Group enjoys a 40% market share thanks to the Roca and Capea brands, with a strong position in the premium market.

More than 300 customers in Argentina and Uruguay at the 20th anniversary of the Group in Argentina (Buenos Aires).

Casa Foa architecture and decoration sample held in Buenos Aires.

UNITED STATES

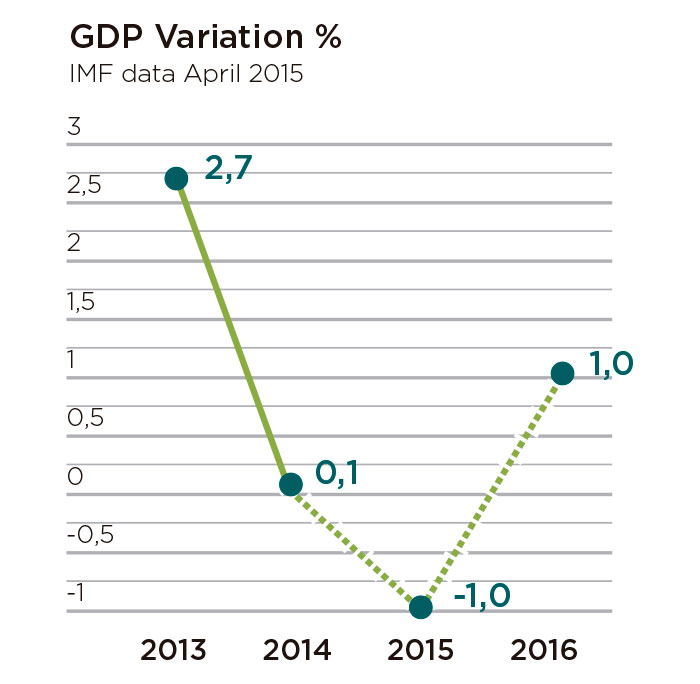

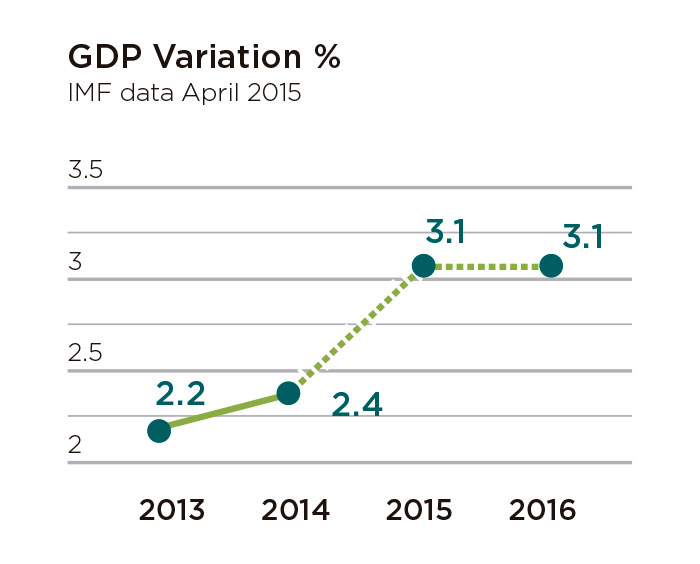

The US economy grew above forecasts due mainly to increased consumption, driven by the reduction of unemployment and falling oil prices. The ceramic tile business posted improved sales as a result of the consolidation in capillarity via small distributors. A new stock management plan was also deployed to reduce warehouse inventory

New showroom in Manhattan. Opened in December 2014 with the aim of providing permanent meeting space for designers and contractors.

Laufen products at the innovative skyscraper at 56 Leonard Street in New York. .

The new Roca Tiles howroom in Manhattan (New York), a meeting point for designers and contractors.