The global economy ended 2014 with 3.4% growth. The United States and China, the two major reference markets, have grown at a rate of 2.4% and 7.4% respectively, while emerging and developing market economies have continued to contribute more than two-thirds of global growth, although at a slower pace than in the past. These positive data are intermingled with certain risks, both economic and geopolitical, which call for maximum caution in analyzing recovery.

The Eurozone still advances slowly, backed by falling oil prices, further relaxation of monetary policies, the more neutral stance of fiscal policy and the recent depreciation of the euro against the dollar, although strong uncertainties remain with regard to the labour market, low inflation and the effects of monetary policy. Moreover, emerging economies have performed very unevenly: China is growing strongly, although at lower rates than in the past; India has implemented rigorous macroeconomic policies and has maintained its growth rate at 7.2%; and Brazil and Russia have witnessed a sharp slowdown, with growth rates of 0.1% and 0.6% respectively.

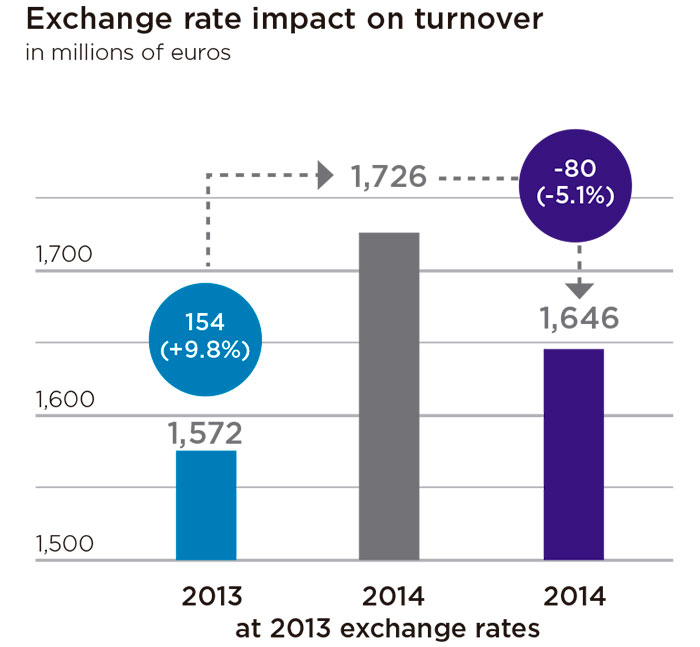

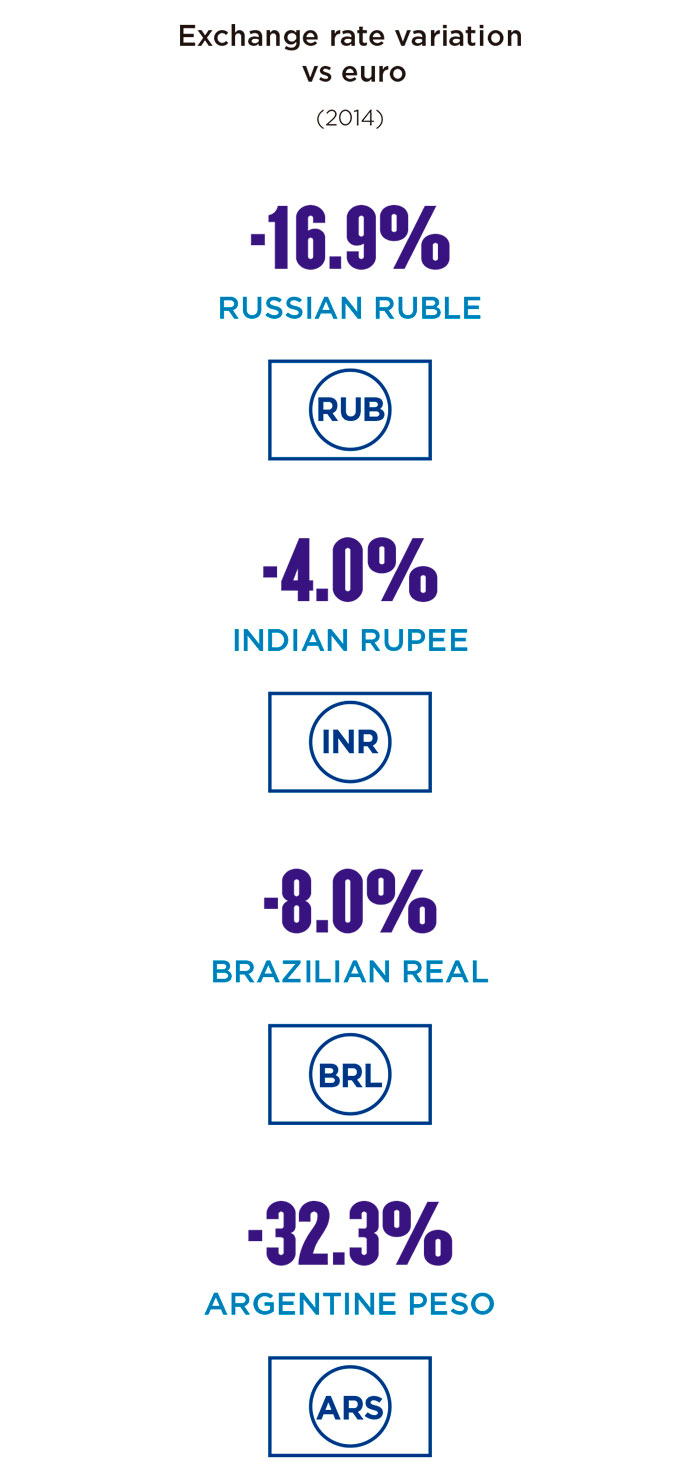

Finally, it is worth noting the sharp appreciation of the euro against other world currencies, especially in emerging countries, with a great influence on the Group’s operations. This assessment is a result of lower growth in these economies due to higher inflation rates, political and social uncertainty in some cases, and strong outflow of speculative capital from these emerging economies and their return to the US, given the possible change in monetary policy by US authorities.

In this still uncertain economic context, the Group’s most relevant economic figures in the year 2014 are as follows:

-

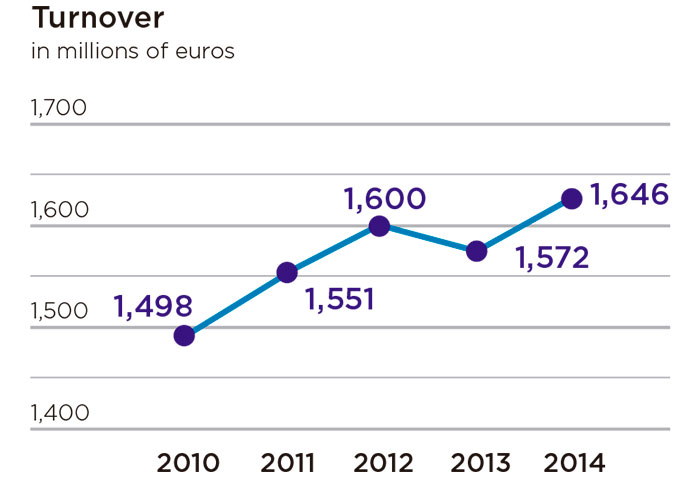

Consolidated turnover was 1,646 million euros, representing an increase of 4.7% with respect to the previous year.

-

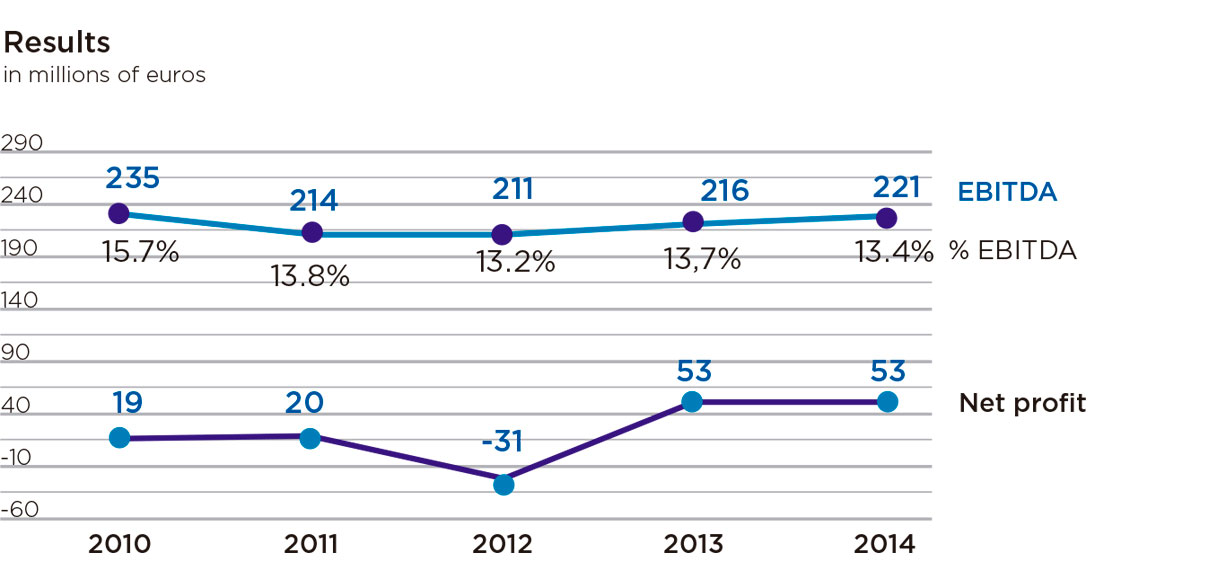

Consolidated EBITDA (the earnings before interest, tax, depreciations and amortizations) was 221 million euros, accounting for almost 13.4% of turnover

-

Consolidated net income — after tax — attributable to the Group reflects a profit of 53 million euros, an amount similar to the previous year.

-

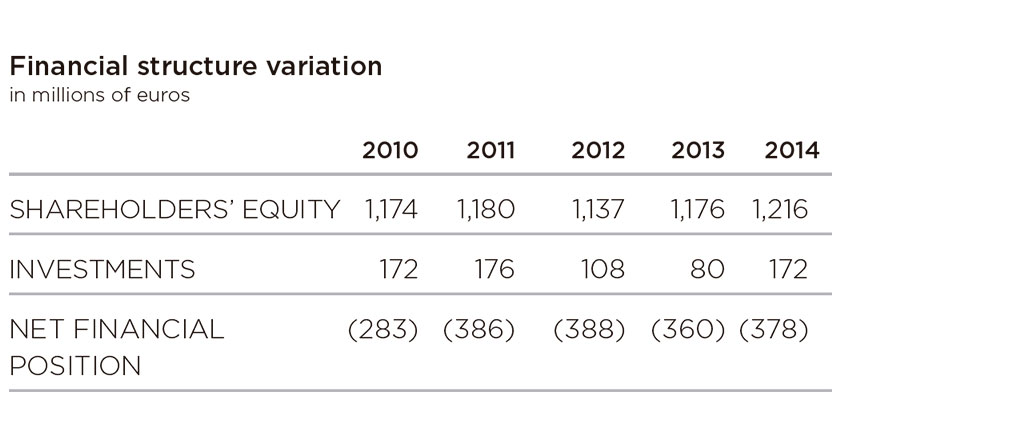

The Group’s shareholders’ equity was 1,216 million euros at year-end 2014, and net financial debt at December 31 2014 stood at 378 million euros.

-

The year’s investments in tangible and intangible fixed assets were 122 million euros compared to 80 million euros in 2013. The key investments focused on the installation of a new line in Brazil to manufacture ceramic tile featuring technical porcelain technology, and expansions in India, Malaysia and China aimed at meeting the growth in demand in their own markets. The various acquisitions that have taken place are also worth noting. Two of them are aimed at increasing our footprint in the markets of Northern Europe and Australia, one involved the acquisition of a supplier in India and, finally, we expanded our shareholding in two companies located in Spain and Egypt, which has involved taking control and management of both.